The story just keeps getting worse as more details about Credit Default Swaps (CDS) emerge daily. CDS were essentially side bets on the performance of other mortgage derivatives, such as mortgage backed securities (MBS) and collateralized debt obligations (CDO).

The story just keeps getting worse as more details about Credit Default Swaps (CDS) emerge daily. CDS were essentially side bets on the performance of other mortgage derivatives, such as mortgage backed securities (MBS) and collateralized debt obligations (CDO).

From Michael Lewis’ The Big Short and other commentary, it was already well documented that A.I.G. was the counterparty on much of the CDS issued by Wall St., being one of the few large companies willing to take the long side of the bet on mortgage default risk. Those selling mortgage default risk to A.I.G. had several risks to consider: 1) that mortgages would perform better than expected, 2) that mortgages would underperform but the counterparty on the trades (e.g., A.I.G.) would become insolvent and not be able to make good on the trades, and 3) that the counterparty would sue the bank issuing the CDS or underlying mortgage securities for fraud and misrepresentation in the creation of the instruments.

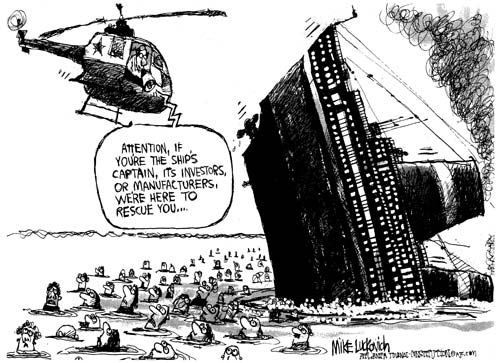

Up to now, Lewis and others, including the New York Times, had focused primarily on the second risk above in pointing out that the Fed’s bailout of A.I.G. had the primary effect of ensuring the solvency of the trading partner of big banks, so that they could collect on their bets against the mortgage market. However, there is now a spotlight on the third risk above, after the House Committee on Oversight and Government Reform released 250,000 pages of largely undisclosed documents showing that A.I.G. was forced to agree to waive its rights to sue several banks – including Goldman Sachs, Societe Generale, Deutsche Bank and Merrill Lynch – over irregularities in the mortgage securities it insured. This fact is only made more appalling by the fact that many of the primary decisionmakers at the New York Fed (which oversees A.I.G. and presided over the bailout) were alumni of the banks that would benefit from this forfeiture, and some even still held stock in those financial institutions.

Sources indicate that this waiver prevents A.I.G. from suing to recover claims it paid on $62 billion worth of mortgage securities that it insured.

For more information, read the article published yesterday in the New York Times, entitled “In U.S. Bailout of A.I.G., Forgiveness for Big Banks.” It pretty much says it all, and if you are not shocked and outraged by what you read, you may want to have your pulse checked.

[Thanks to Manal Mehta for being the first to bring this story to my attention – IMG]