This is the fourth installment in my countdown of the Top 5 RMBS Cases to Watch this Summer. Click on the following links to read parts I, II, and III. Today, we address a case that is anything but typical, but which if successful, could become the template for global RMBS settlements for many of the banks burdened by legacy mortgage liabilities.

No. 2 – In re the Application of Bank of New York Mellon (Article 77 Proceeding)

It’s no secret that BNYM’s proposed $8.5 billion settlement with BofA and Countrywide over breaches of reps and warranties (a.k.a. mortgage put-backs) is one of the most important and influential pieces of ongoing RMBS litigation. The approval of this settlement could put the bulk of BofA’s legacy mortgage issues behind it while creating a framework for other RMBS originators, issuers and trustees to settle their outstanding mortgage liabilities.

What many people with whom I speak don’t seem to understand, however, is how this settlement came about, and the fact that it was not the product of a typical adversarial process. Namely, certain large institutional investors with complex and interwoven relationships with BofA, a bank’s bank that could face liabilities for wasting valuable put-back claims if it doesn’t act, and a too-big-to-fail bank that is being crushed under the weight of its legacy mortgage liabilities are endeavoring to settle claims on behalf of the entire universe of Countrywide bondholders. And in order to do so, they have to convince a New York state court judge that the decision to settle settlement amount and process are reasonable.

In the epilogue to this series of articles, I’m going to talk about end game scenarios for mortgage litigation, and how the concept of “proof” will be an integral factor. Currently, there is so little precedent in RMBS litigation and thus so few established facts or “proof” of wrongdoing or liability, that it’s possible for the various players to have wildly differing views of the potential outcomes and associated liabilities. This greatly affects their loss reserves and settlement posture associated with legacy mortgage obligations.

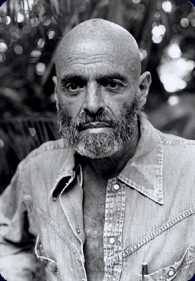

Thus, it remains possible for the major banks to justify under-reserving for private label mortgage repurchases by stating that they have insufficient experience with these types of put-backs to set an accurate reserve amount (see  this recent repurchase report from Natoma Partners for an accounting perspective on the banks’ ever-growing loss reserves). It also allows BNYM, BofA and the Kathy Patrick-led institutional investors to justify settling Countrywide bonds with over $200 billion of losses to date for a mere $8.5 billion by appealing to untested legal defenses and repurchase statistics from BofA’s dissimilar deals with the GSEs. I’m reminded of a Shel Silverstein poem from one of my favorite childhood books, Where the Sidewalk Ends, entitled, “No Difference.” Though at its core, this was probably a poem about racial bias, this stanza seems particularly applicable here:

this recent repurchase report from Natoma Partners for an accounting perspective on the banks’ ever-growing loss reserves). It also allows BNYM, BofA and the Kathy Patrick-led institutional investors to justify settling Countrywide bonds with over $200 billion of losses to date for a mere $8.5 billion by appealing to untested legal defenses and repurchase statistics from BofA’s dissimilar deals with the GSEs. I’m reminded of a Shel Silverstein poem from one of my favorite childhood books, Where the Sidewalk Ends, entitled, “No Difference.” Though at its core, this was probably a poem about racial bias, this stanza seems particularly applicable here:

Rich as a sultan,

Poor as a mite,

We’re all worth the same

When we turn off the light.

So long as we’re in the dark about how courts will interpret RMBS trust agreements, all arguments and defenses are worth the same. But if those defenses are rejected by courts or the GSE repurchase numbers are shown to be wildly disparate from private label liabilities, it would begin to illuminate the true value of these arguments, and this settlement could come under heavy fire and ultimately be rejected by Judge Barbara Kapnick (yes, the same judge who heard BofA’s Article 78 challenge to MBIA’s restructuring).

In the context of the final RMBS case to watch (coming tomorrow), we will talk about how some of BofA’s untested legal defenses (which BNYM used to justify the $8.5 billion settlement amount) could be tested in court, and why BofA and BNYM are thus eager to complete the Article 77 settlement approval process before other major RMBS cases reach trial. In this segment, I’ll review how developments in the Article 77 proceeding itself threaten to undermine the metrics used to justify the settlement.

The biggest recent development is that Judge Kapnick has approved the petition of the New York and Delaware Attorneys General to intervene in the case. In her ruling, Kapnick first noted that “[t]here appears to be no precedent to the scenario here,” which she called “admittedly a very unique proceeding, and which is also arguably ‘the largest private litigation settlement in history.’”

Ultimately, however, Kapnick found that the AGs had articulated legitimate “quasi-sovereign” interests in the litigation – securing an honest marketplace and eliminating fraudulent and deceptive business practices – and ruled that the AGs had parens patriae standing to intervene. She further found that there was no reason to believe that the AGs’ intervention would be the source of unnecessary delay, as “the Court will control the discovery process and is already working with the parties to move discovery forward.”

Interestingly, Judge Kapnick cited Judge Pauley’s prior Order granting the AGs’ petition to intervene while the case was in federal court. She found that while Pauley had been overturned by the Second Circuit as to his Order Denying Remand, the Second Circuit had not specifically or explicitly vacated his Order granting the AGs’ motion to intervene, meaning she could consider it as an “advisory opinion.” As I noted in an article a few weeks back, though Judge Pauley is no longer overseeing this case, he continues to have a major impact on these proceedings.

What AG intervention means is that a vocal, independent and influential party will have the right to participate in the case as if it were any other party to the proceeding. New York AG Eric Schneiderman has already shown that he believes BNYM was one of the bad actors that perpetuated and worsened the mortgage crisis, and will likely continue to take aggressive steps to uncover evidence of trustee misconduct in discovery. These may include tackling the issue of whether home loans were incorrectly transferred into the trust in the first place, an issue that investors have been reluctant to touch (until recently), but which the AGs have indicated that they seek to investigate. So, while Kapnick does not anticipate AG intervention causing “unnecessary delay,” this does not mean that the AGs won’t influence the scope of discovery, and potentially lengthen the discovery timeline.

Should the AGs threaten to expose particularly damaging evidence in discovery, it could force BNYM and BofA to negotiate with the AGs to find out what it would take to make them go away. Should the AGs, to whom Judge Kapnick will likely show some deference as the highest-ranking prosecutors of their respective states, actually expose damning evidence of misconduct by those parties, it will make it more difficult for Kapnick to rubber stamp the settlement.

The other major development in the Article 77 proceeding has been the battle over loan files, the outcome of which is something to watch closely this summer. Debtwire reports that Judge Kapnick will hold a hearing on this topic at 2 PM ET today. While Kapnick had initially told the parties to meet and confer to select an initial number of loan files to review between 150 and 500, the investor Steering Committe now argues that this will take over seven months and yield little of use.

I’ve spoken at length about the importance of loan files, the documents that contain black and white evidence of whether loans met underwriting guidelines, and this case is no different. Investors challenging the settlement want access to files to show how many loans are actually deficient; BofA and BNYM want to avoid getting too granular about the trustee’s estimates of deficiencies and focus instead on the reasonableness of the process used by the trustee to reach the settlement figure.

BofA has actually intervened with a petition on its own behalf for the first time in the state court case (note that BofA is not technically a party to the Article 77 proceeding, but is now the subject of a third-party request for documents, as it holds the loan files), to argue as to why the court should not order the production of significant loan files. Interestingly, BofA states that, “[l]oan-file review will answer no questions. It will lead only to interminable delay and unnecessary litigation, loan-by-loan-by-loan. It will bog down this proceeding for no good reason.” I can’t resist pointing out the irony of this statement after CEO Brian Moynihan famously said during BofA’s Q3 2010 earnings call, in minimizing the company’s potential put-back losses:

This really gets down to a loan-by-loan determination and we have, we believe, the resources to deploy against that kind of a review… we will go in and fight this. It’s worked to our benefit to—we have thousands of people willing to stand and look at every one of these loans.

Curious how the bank will advocate a loan-by-loan review when it works to its benefit (by driving up the timeline and costs of put-backs), but will argue just as ferociously that loan level review is unnecessary when asking a court to approve as reasonable its sweetheart settlement with a favored group of investors.

This irony is not lost on the counsel for the Steering Committee of investors who are challenging this deal. Though in their first letter, they argued that this issue was not yet ripe for review and that BofA’s opposition brief is untimely, they have now responded with a short brief of their own, which is well worth reading. Therein, they note that:

- Loan files are essential to test the Trustee’s assumption that the settlement was reasonable;

- BofA has produced hundreds of thousands of loan files in other litigation, so the burden cannot be that great; and

- BofA is exaggerating the time it will take to review and present evidence of breaches, since this info can be presented in the aggregate.

Most interestingly, the Steering Committee attacks head-on BofA’s claim that its repurchase experience with the GSEs is an appropriate measuring stick, and the result of an extended, adversarial and arm’s length process. In that regard, counsel points out that:

- GSE Guidelines were less stringent with respect to credit, repayment ability and collateral;

- The FHFA has since reported that Freddie Mac had a flawed loan review methodology and failed to review 300,000 loans potentially subject to repurchase by BofA; and

- The FHFA’s office of the inspector general reported that Freddie Mac management asserted the need to maintain relationships with loan sellers such as BofA as a factor weighing against more expansive loan review and put-back process, which undermines the argument that BofA’s GSE experience reflects actual arms-length, adversarial negotiations.

The Steering Committee ultimately advocates for a review of between 4,630 and 6,470 loans in order to generate a statistically significant sample. It maintains that the sample of about 150 non-random loans that BofA has purportedly offered to produce would not be statistically significant or inform the opinion of its expert.

At the end of the day, Article 77 provides BNYM and BofA a highly advantageous playing field on which to litigate the reasonableness of this settlement, as it restricts the Judge to a binary decision (to accept or reject the settlement) under a favorable standard (arbitrary and capricious). The banks would prefer that Judge Kapnick not look too closely or shine too much light on the deal, and instead presume that it was the product of honest, adversarial negotiations.

However, the more evidence the Steering Committee and the AGs can compile to show that the Trustee ignored evidence, relied on unreasonable assumptions, and/or chose a dollar figure far below what it could have expected from litigation, the better chance they have of making Judge Kapnick just uncomfortable enough to send BNYM back to the drawing board. And the decisions of other courts adjudicating RMBS litigation could also help to illuminate the problems with this settlement, discouraging other issuers from using the Article 77 template to resolve their own mortgage problems. The implications of this case make it one to watch throughout this summer, and until its resolution (likely sometime in late 2013).

Click here to continue to the final post in this series on the No. 1 RMBS Case to Watch this Summer.