Will we look back at this point in the mortgage crisis fallout as the turning point for RMBS investors? With the news that Wells Fargo, as securitization trustee, has sued EMC Mortgage in Delaware Chancery Court over loan files, trustee cooperation with bondholders is starting to feel distinctly like a trend, and I can’t help but hear the words to Bob Dylan’s famous folk anthem in my head:

You better start swimming or you’ll sink like a stone/

For the times, they are a-changin’

According to Bloomberg, Wells Fargo is seeking over 2,000 loan files underlying mortgages in Bear Stearns Mortgage Funding Trust 2007-AR2, based on “serious” questions raised by investors in the trust regarding whether EMC, a wholly-owned subsidiary of JP Morgan, complied with its reps and warranties when originating the loans. Wells Fargo further stated in the Delaware complaint that it had received a letter from attorney David Grais (who was the moving force behind Greenwich v. Countrywide, the FHLB SF case and the FHLB Seattle case) on behalf of an unnamed hedge fund purporting to hold 42% of the bonds in this deal. In that letter, Grais stated that he had investigated 1,317 loans held by the trust on behalf of his client and found that 938 breached EMC’s reps and warranties–a whopping 71% deficiency rate!

This is the second major battle currently being fought by a RMBS trustee to pursue bondholder interests. In the District Court of Washington, D.C., Deutsche Bank is suing JP Morgan and the FDIC over loan repurchase responsibilities for mortgages in at least 159 WaMu-sponsored securitizations. Though a major issue in that case is who should be left holding the bag for WaMu’s bad loans between the FDIC, the conservator of WaMu, and JPM, the purchaser of the failed bank, the issue of loan files is also at the forefront. Just last week, Deutsche Bank filed a response to the Motions to Dismiss filed by JPM and the FDIC, and the Partial Motion for Summary Judgment filed by JPM, arguing that JPM is in continuing breach of its obligations to turn over loan files to the Trustee upon “reasonable notice.” Deutsche Bank maintains that it should not be punished for failing to identify specific loans that are subject to repurchase in its Complaint when JPM is withholding that information in violation of its obligations in the relevant Pooling and Servicing Agreements.

So that’s two major trustees who are taking very aggressive approaches towards JP Morgan and its affiliates regarding their refusal to turn over loan files. Could it be that the trustees are starting to realize that bondholders will eventually mobilize, and they don’t want to be caught in the crosshairs?

For he that gets hurt will be he who has stalled/

There’s a battle outside and it is ragin’/

It’ll soon shake your windows and rattle your walls/

For the times they are a-changin’

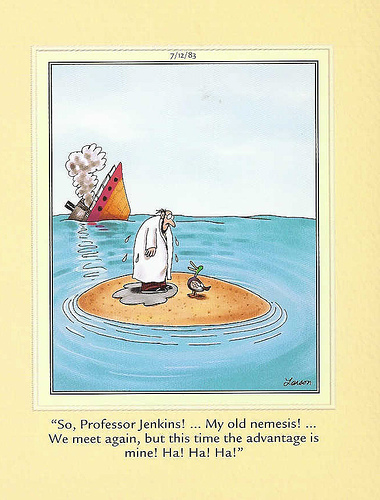

This passage could apply to EMC and other servicers who have thrown up road block after road block to investor attempts to get the loan files underlying their investments. Colorfully, Wells Fargo states in its complaint against EMC that it had repeatedly asked the servicer for these documents, but, “EMC has played proverbial ‘rope a dope’ and otherwise continued to drag its feet, and has produced nothing.” These loan files are expected to be treasure troves for putback claims, rife with evidence of poor underwriting and defective origination.

But Dylan’s lyrics about the costs of stalling could also apply to the pension funds, insurance companies and other institutional investors who are sitting on their hands while the statute of limitations clock ticks on billions of dollars worth of distressed RMBS in their portfolios. In fact, these investors may have already blown the chance to raise securities fraud claims as to 2005-vintage MBS, while the window for rep and warranty claims as to the ’05 collateral will slam shut by the end of this year.

Your old road is rapidly agin’/

Please get out of the new one if you can’t lend your hand/

For the times they are a-changin’

Though servicers and trustees are both contractually obligated to act in the interests of the trust and the ultimate bondholders, as the owners of the trust, neither group had responded to repeated bondholder calls for action, let alone gone out of their way to find out how so many poor candidates for mortgage credit slipped through the cracks from 2005 to 2008. Until recently. The word on the street is that the same investors who were getting stonewalled by their trustees one year ago are now finding the trustees more receptive to their requests for investigations, loan files, and the initiation of repurchase requests.

This could have something to do with the anticipation building around the Investor Syndicate, which, according to this Bloomberg article, now boasts that it represents 1,325 trusts with at least a 50% ownership stake (and over 3,200 trusts with a 25% ownership stake). This 50% magic number means that investors could fire and replace trustees and servicers that the bondholders feel have breached their contractual obligations. The trustees seem to be recognizing that while they were willing to drag their heels at first in the name of industry solidarity, this isn’t their battle, and they don’t want to find themselves on the hook for the errors and omissions of subprime lenders.

Come senators, congressmen, please heed the call/

Don’t stand in the doorway, don’t block up the hall

Which brings us to the servicers like EMC who are still refusing to cooperate with demands for loan files. Though their contractual obligations require them to act in the interest of bondholders, even at the expense of their own interests, the major servicers are all affiliates of major subprime lenders, and are thus far too interested to let a little thing like a contract stand in their way. That is, if EMC begins turning over files, it would open the floodgates to putback claims against its parent, JP Morgan Chase.

This is the reason that congressmen like Brad Miller have begun urging federal regulators to use their authority under the Frank-Dodd Act to force large financial institutions to divest their loan servicing arms. Though this recognition by Washington comes late in the game–and after many failed efforts to induce servicers to modify loans without understanding their conflicts of interest (see, e.g., my series of articles about the Servicer Safe Harbor)–letters like Miller’s are an encouraging sign that even the politicians are beginning to see the writing on the wall. This battle will eventually be brought to the door of the major subprime lenders, or the Big Four banks foolish enough to have taken on their liabilities, and you don’t want to be caught standing in the way of that tidal wave. To quote another great Dylan track, for subprime and Alt-A lenders, it’s a hard rain’s a-gonna fall.

Now that trustees appear to be giving in to the momentum building around loan putbacks, a major procedural hurdle that has been hampering prior bondholder efforts will be swept aside. Now, so long as investors can pull together 25% or more of the Voting Rights in a particular deal, and offer the trustee some credible evidence of shenanigans in the servicing or underwriting of the loans in the trust, they should be able to convince the trustee to act on their behalf, making it significantly easier to get loan files and initiate repurchase requests. So, while only time will tell, this moment could indeed be the point we look back upon in private label putback efforts and say “that’s when everything changed.”

The order is rapidly fadin’/

And the first one now will later be last/

For the times they are a-changin’