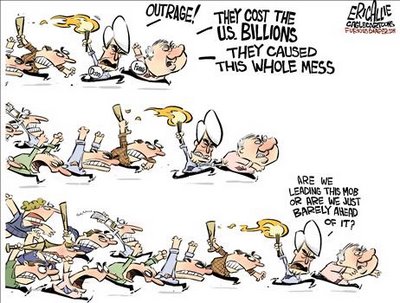

Bank stocks have taken a sharp hit this week as awareness regarding potential liabilities for faulty mortgages and foreclosures reaches critical mass.

You can’t turn on the TV or open a newspaper these days without seeing reports on the recent “Foreclosure Crisis” and the resulting foreclosure moratorium. For those who have been napping, this latest crisis surrounds the issue of whether the major loan servicers were dealing with the glut of foreclosures on their books by hiring inexperienced employees to act as “robo-signers,” signing thousands of affidavits attesting to facts of which they had no knowledge. Deposition testimony from a number of foreclosure cases has recently emerged that reveals a huge number of judicial foreclosures may have rested upon phony affidavits, and that these affidavits were the only proof provided by the banks that they had the right to foreclosure on delinquent borrowers.

While this issue has been brushed off by some as a mere administrative problem that can easily be remedied, the reaction of informed analysts and the major servicers themselves says otherwise. BofA has now frozen foreclosures in all 50 states, even those not requiring judicial intervention to effectuate a foreclosure, joining JPMorgan Chase and Ally Financial (formerly GMAC), which had previously imposed a foreclosure moratorium in the 23 judicial foreclosure states. Moreover, it is unclear how long these moratoria may last, as banks may not even possess the proper documentation to cure this defect and prove the right to foreclose. A riveting and terrifying report by analyst Joshua Rosner has been circulating that argues that the banks may not have properly assigned the mortgages to the securitizations to which they were sold in the first place (see CNBC article here and great post on Naked Capitalism about the Rosner report here). If true, this would mean that bondholders were not provided the consideration they bargained for, as their investments were essentially unsecured, rendering the investment contracts subject to rescission. At the very least, this fact would render all improperly-assigned loans subject to repurchase for breach of the rep and warranty regarding a true sale of the mortgages to the trust, providing private-label investors, such as the Investor Syndicate, even more ammunition to use against banks and originators.

In addition, a great report called “Foreclosures Gone Wild,” explaining the nature and implications of the Foreclosure Crisis, was published by, of all entities, CitiBank (which has not yet frozen foreclosures) this week. The report (text version available here), cites the comments Georgetown professor Adam Levitin made during a conference call hosted by the bank. While Citibank tempers these comments by describing them as “one of the bleaker portraits of these matters and their ultimate resolution,” you’ve got to wonder whether someone at Citi is currently on the Budweiser Hot Seat over the decision to select Levitin as the featured guest.

Adding fuel to this foreclosure fire, banks are holding their Q3 earnings calls this week, and are expected to announce additional litigation reserves and loss reserves for mortgage repurchases. JPMorgan has already announced a $1billion increase in repurchase reserves, and the transcript from the earnings call held by bank CEO Jamie Dimon earlier this week is great reading, both for what Dillon says and for what he doesn’t say. Pay particular attention to the sections of the Q&A where Dimon confirms the banks’ apparent strategy to drag out the losses from mortgage repurchases through litigation, and his warnings that a prolonged foreclosure crisis would have “a lot of consequences, most of which would be adverse on everybody.”

On top of this, a report written by Manal Mehta, who has been a guest blogger on the Subprime Shakeout (read Mehta’s guest post on JPMorgan’s insufficient mortgage repurchase reserves here), has suddenly gone viral, and is having a material impact on the stock price of lenders and bond insurers. Manal’s report was originally circulated in August, but got hundreds of thousands of hits in the last two days when it was posted on the website Business Insider. The report details why Mehta, and his fund Branch Hill Capital in San Francisco, believe that Bank of American has undereserved for potential losses associated with repurchases of defective residential mortgages and why bond insurers such as MBIA will benefit from such repurchases. The report has now been cited by The New York Times, The Street, and was featured on CNBC (see article and video here).

As the market reaction shows, not only are Wall Street analysts finally delving into reports on mortgage repurchase liability such as Mehta’s, but that the Street is coming to understand that repurchase liability is real, and poses a credible threat to banks’ balance sheets. Though there are certainly procedural hurdles to enforcing bondholder rights that must be overcome, and the dismissal of Greenwich Financial’s lawsuit against Countrywide last week vividly illustrates the importance of complying with these preconditions, I believe that these hurdles can be properly navigated by experienced counsel, and that RMBS bondholders will eventually get their act together take the proper steps to bring massive claims against the banks. And while the putbacks from breaches of underwriting guidelines or procedures alone could be well over 50% of these 2005 to 2007-era subprime and Alt-A pools, that number could skyrocket should analysts’ fears regarding improper assignment of mortgages prove actionable.

[Update: after linking to Citi’s report entitled, “Foreclosures Gone Wild,” complete with the statement that, “[i]t appears that in many instances during the mortgage securitization process over the past few years, the paperwork was not properly transferred,” I learned that Citi had apparently hired the firm of Kilpatrick Stockton LLP to remove the report from all Internet sites that posted it in its original form. This article now links to the text from the repo

rt, which can be found at Foreclosure Blues. Citi’s official response to this decision to take down the report was as follows: