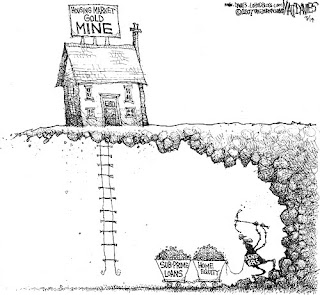

In a move that represents a significant and unexpected expansion in U.S. regulators’ efforts to crack down on Wall Street, the Securities and Exchange Commission (“SEC”) has charged Goldman Sachs, Wall Street’s most powerful bank, with fraud over its marketing of a subprime mortgage derivative product. The complaint alleges that Goldman designed and marketed a “synthetic collateralized debt obligation” (“CDO”) known as ABACUS 2007-AC1 in order to give investor Paulson & Co., Inc. the ability to short subprime mortgage bonds, without disclosing to the bank on the other side of the deal of the bond insurer that was acting as the deal manager that Paulson had shorted more than $1 billion of the securities. Details of the complaint are still emerging, but this Reuters Factbox contains a good summary of the complaint and the details of ABACUS 2007-AC1.

We are disappointed that the SEC would bring this action related to a single transaction in the face of an extensive record which establishes that the accusations are unfounded in law and fact. We want to emphasize the following four critical points which were missing from the SEC’s complaint. 1) Goldman Sachs Lost Money On The Transaction. Goldman Sachs, itself, lost more than $90M. Our fee was $15M. We were subject to losses and we did not structure a portfolio that was designed to lose money. 2) Extensive Disclosure Was Provided. IKB, a large German Bank and sophisticated CDO market participant and ACA Capital Management, the two investors, were provided extensive information about the underlying mortgage securities. The risk associated with the securities was known to these investors, who were among the most sophisticated mortgage investors in the world. These investors also understood that a synthetic CDO transaction necessarily included both a long and short side. 3) ACA, the Largest Investor, Selected The Portfolio. The portfolio of mortgage backed securities in this investment was selected by an independent and experienced portfolio selection agent after a series of discussions, including with Paulson & Co., which were entirely typical of these types of transactions. ACA had the largest exposure to the transaction, investing $951M. It had an obligation and every incentive to select appropriate securities. 4) Goldman Sachs Never Represented to ACA That Paulson Was Going To Be A Long Investor. The SEC’s complaint accuses the firm of fraud because it didn’t disclose to one party of the transaction who was on the other side of that transaction. As normal business practice, market makers do not disclose the identities of a buyer to a seller and vice versa. Goldman Sachs never represented to ACA that Paulson was going to be a long investor.

Paulson & Co., Inc., who made waves by posting yearly returns in the 300-600% range in the aftermath of the global financial crisis by shorting subprime and Alt-A mortgage-backed securities, has not been formally charged with any wrongdoing by the SEC. However, the company also issued a statement regarding the SEC’s Complaint, which was posted on Dealbreaker this afternoon:

As the SEC said at its press conference, Paulson is not the subject of this complaint, made no misrepresentations and is not the subject of any charges.

While Paulson purchased credit protection from Goldman Sachs on securities issued under the ABACUS ABS CDO program, we were not involved in the marketing of any ABACUS products to any third parties.

ACA as collateral manager had sole authority over the selection of all collateral in the CDO, securities of which were subsequently rated AAA by both S&P and Moody’s.

Paulson did not sponsor or initiate Goldman’s ABACUS program, which involved at least 20 transactions other than that described in the SEC’s complaint.

SOURCE Paulson & Co. Inc.

If the writing wasn’t already on the wall, this complaint makes official the shift in U.S. regulatory policy from one of protecting large Wall St. banks to one aimed at holding them accountable. This should only encourage mortgage insurers and mortgage bond investors to ramp up their efforts to recover losses from lenders through the courts. We will certainly be following this story as it develops.