I have seen some strange things during my time covering the mortgage crisis, but this one may beat them all.

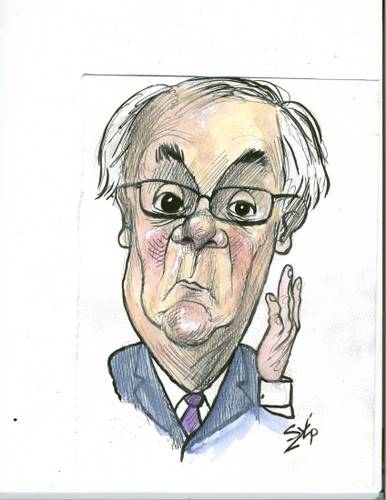

On August 20, 2010, representative Barney Frank (D-MA) sent a letter to Barack Obama, urging the President to appoint a permanent head of the Federal Housing Finance Agency (FHFA) who would aggressively pursue legal claims against the private companies that caused Fannie Mae and Freddie Mac (and thus, taxpayers) to suffer losses, namely, the lenders who originated subprime and Alt-A mortgages during the boom years (roughly 2005 to early 2008). Frank’s letter directly endorses a similar letter sent by representative Paul Kanjorski (D-PA) and the House Financial Services Committee on August 13, 2010, which also urged Obama to appoint an FHFA director to “vigorously pursue all legal claims for losses” sustained by Fannie and Freddie and identified specific legal action the FHFA has taken and should continue to take to recover these losses. Kanjorski’s letter went into greater detail, indentifying the pursuit of mortgage repurchases for rep and warranty violations, the issues private investors had experienced in accessing loan files, the FHFA subpoenas designed to acquire those loan files, and the servicer conflicts of interest that had contributed to their obduracy.

If my readers will recall, some of these same officials had previously taken positions that were vehemently and diametrically opposed to encouraging the pursuit of legal rights against servicers (often affiliates of the same entities that originated these defective loans), and in fact had supported measures that helped protect servicers from legal liability. For example, in October of 2008, Frank was among the congressional signatories on a letter sent to Bill Frey of Greenwich Financial Services, which has filed a lawsuit against Countrywide to prevent the servicer from modifying mortgages without bondholder approval, as required by contract. Frey had long been a vocal bondholder advocate who had publicized the various servicer conflicts of interest and breaches of their obligations to service mortgages in the best interests of bondholders. Frank’s October 2008 letter accused Frey of interfering with Washington’s attempts to avoid foreclosures by encouraging loan modifications, and “invited” Frey to testify before Congress to explain himself. Frey wrote a letter in response, and ended up showing up in Washington to testify, but was never called to the stand.

In another example, both Kanjorski and Frank were sponsors of the Helping Families Save Their Homes Act, a bill passed in 2009 with the ostensible goal of reducing foreclosures, but which attempted to do so by incentivizing servicers to modify mortgages with cash and legal immunity, courtesy of a Servicer Safe Harbor (introduced by Kanjorski and Michael Castle (R-DE)). This Safe Harbor purported to nullify any contractual provisions that required servicers to buy-back the loans that they modified. Soon after, Frey wrote a scathing Op-Ed piece in the Washington Times explaining why servicer conflicts of interest would doom any effort to make them the arbiters of loan modifications. I have also written several articles identifying the folly of this legislation (see examples from the Subprime Shakeout here, here and here, and a longer article on the background and constitutionality of this legislation here) and pointing out how Kanjorski was the second-largest recipient of Countrywide campaign contributions since 1989. It is also interesting to note that Frank’s second-largest donor during the 2008 election cycle was Bank of America, and that Frank’s top 20 donors included Royal Bank of Scotland (No. 4), JPMorgan Chase (tied at No. 11), Credit Suisse, Goldman Sachs and Morgan Stanley (all tied at No. 17).

Frank later began to reverse course in July 2009, issuing a public letter urging regulators to investigate servicer conflicts of interest, including those resulting from their holdings of second lien loans. This indicated that Frank was beginning to realize that it wasn’t bondholders who were truly preventing distressed loans from being modified, but the very same banks that had originated the defective loans in the first place.

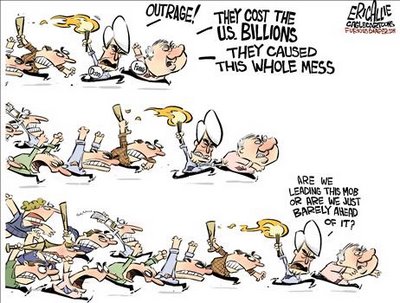

Over the next year, it became apparent that Frank wasn’t just talking out of both sides of his mouth, but that he really had changed positions on this issue. This could have been a result of a change in conscience, but more than likely, it was a result of a change in the political landscape and the fact that Frank has a legitimate fight on his hands to achieve reelection in 2010. Tellingly, none of Frank’s former top-20 Wall Street donors from 2008 or any major banks are anywhere to be found in Frank’s list of top donors for the 2010 election cycle.

In July 2010, the Frank-Dodd Financial Reform Bill was signed into law, consisting of 2,000 pages of legislation aimed at halting abusive practices in the mortgage industry and preventing another financial crisis, but which left many of the specifics of such reform for regulators to fill in over the next 6 to 18 months. Frank was a major force behind the bill, as its name suggests, and, in a revealing interview with Charlie Rose, Frank hailed the bill as a victory over Wall Street and discussed the challenges of taking on the banks.

In July 2010, the Frank-Dodd Financial Reform Bill was signed into law, consisting of 2,000 pages of legislation aimed at halting abusive practices in the mortgage industry and preventing another financial crisis, but which left many of the specifics of such reform for regulators to fill in over the next 6 to 18 months. Frank was a major force behind the bill, as its name suggests, and, in a revealing interview with Charlie Rose, Frank hailed the bill as a victory over Wall Street and discussed the challenges of taking on the banks.

For example, at the 12:20 point in the interview, Frank states that banks were most afraid of (and put most of their guns into opposing) the new consumer protection bureau because they make most of their money on credit card overdraft charges and late fees, rather than loans. Frank then says, “And [the banks] lost.” That’s when it gets really interesting, as Frank says, “they told me not even to try because the banks always win… They didn’t win today.”

At the 19:35 point, Frank makes another revealing comment. He begins by saying, “public opinion is powerful.” He notes that last year’s bill (probably referring to the Helping Families Save Their Homes Act) was not as powerful as this bill because the media was more focused on health care, “so the big interests won more of the fights than I wanted them to or than I wish they did….” Though it’s easy to be skeptical of comments such as this, Frank’s almost wistful tone in making this statement (watch the video and see if you disagree) leaves the indelible image of a man who has been misled by those he trusted.

Thus, I had some inclination of a falling out between Wall Street and Frank, but I must say I was surprised by Frank’s recent letter regarding the FHFA. It isn’t just that he is now taking a more strident stand against the banks that supported him during the last election cycle, but that, by advocating mortgage repurchases, Frank has now aligned himself (perhaps unwittingly) with the former target of his wrath, Bill Frey.

On September 23, 2010, it was revealed that Frey was involved in efforts by the Investor Syndicate to do just what Frank’s letter to the President urges – pursue legal claims against residential mortgage originators for defective underwriting and breaches of reps and warranties. With their interests now so closely aligned, maybe Frank should recommend that the President appoint Frey as the head of the FHFA. After all, Frey was way out in front of this issue and has the experience to do the job. It’s safe to say that such a development wouldn’t be any stranger than the recent vicissitudes in Frank’s relationship with Wall Street.